No-fault states consist of: What Other Variables Influence Cars And Truck Insurance Coverage Rates? Your age and also your house state aren't the only things that impact your rates. Insurance companies utilize a range of elements to identify the price of your costs. Here are some of the most important ones: If you have a clean driving record, you'll locate much better rates than if you've had any kind of recent mishaps or traffic offenses like speeding tickets.

Others use usage-based insurance policy that might save you cash. If your cars and truck is one that has a probability of being taken, you might have to pay even more for insurance policy.

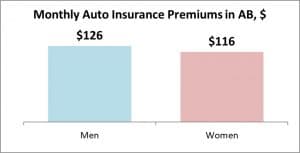

However in others, having bad debt might cause the expense of your insurance policy premiums to rise dramatically. Not every state enables insurance companies to use the sex listed on your chauffeur's license as a figuring out factor in your premiums. Yet in ones that do, women motorists usually pay a little less for insurance policy than male vehicle drivers. car.

Why Do Cars And Truck Insurance Rates Modification? Looking at ordinary automobile insurance policy prices by age and state makes you question, what else impacts prices?

An at-fault accident can raise your rate as a lot as 50 percent over the next three years. On the whole, vehicle insurance coverage often tends to obtain a lot more expensive as time goes on.

Tesla Bets It Can Bring Down Insurance Costs, Make Driving ... - Questions

There are a number of other discounts that you may be able to utilize on right currently. Here are a few of them: Numerous business offer you the largest price cut for having a good driving history. Likewise called bundling, you can get lower rates for holding greater than one insurance coverage with the exact same company.

Property owner: If you have a house, you can obtain a property owner discount from a number of carriers. Get a discount for sticking to the very same firm for several years. Below's a trick: You can always contrast prices each term to see if you're obtaining the best rate, despite having your loyalty price cut.

credit cars vehicle insurance auto insurance

credit cars vehicle insurance auto insurance

Nevertheless, some can likewise elevate your rates if it transforms out you're not an excellent chauffeur. Some companies give you a discount rate for having a great credit rating. When looking https://objectstorage.us-sanjose-1.oraclecloud.com for a quote, it's a good concept to call the insurance provider and also ask if there are anymore price cuts that relate to you.

Usually, the rate for a full-coverage plan can set you back from $1300 in Maine to $8700 in Michigan. It can additionally vary within a state according to take the chance of consider particular areas. If you live or save your car in a location that is considered "high risk," whether it's due to regular collisions, criminal offense, or weather, you may have a higher insurance price than a motorist with a comparable profile in a different location - car insurance.

Minimum coverage is the least pricey policy you can get for your vehicle, however it only covers the minimum demands by regulation from the state. With complete protection, you have comprehensive and crash protection in enhancement to the minimal insurance coverage. Though this option is a lot more costly, it comes with more protection for your car.

What Is The Average Monthly Cost Of Car Insurance In California? for Beginners

Youthful or inexperienced chauffeurs are a higher risk for the insurance coverage business, which is why they have greater insurance coverage costs. As soon as chauffeurs are 30 or older, auto insurance costs are influenced by gender.

In the states that enable gender-based prices, the distinction in premiums between guys and females is much less than 1 percent. The six-month typical automobile insurance coverage premiums by gender are: Male: $734.

Among the most significant aspects for customers aiming to buy vehicle insurance is the rate. Not only do prices differ from firm to firm, but insurance prices from state to state differ. According to , the ordinary annual expense of auto insurance in the United States was $1,633 in 2021 and is predicted to be $1,706 in 2022.

Typical prices differ commonly from one state to another. liability. Insurance coverage rates are based on multiple criteria, including age, driving history, credit rating, how numerous miles you drive each year, automobile kind, as well as more. Counting on average car insurance policy costs to approximate your cars and truck insurance costs might not be the most precise method to determine what you'll pay.

, and you may pay even more or less than the average chauffeur for protection based on your risk profile. Younger chauffeurs are typically much more most likely to get into a mishap, so their costs are generally greater than average.

See This Report about How Much Does Car Insurance Cost On Average? - The Zebra

It may not provide sufficient defense if you're in a mishap or your automobile is damaged by another covered occurrence. Interested regarding how the typical cost for minimal protection piles up versus the expense of complete coverage?

laws vehicle insurance cheapest car auto insurance

laws vehicle insurance cheapest car auto insurance

Yet the only way to recognize precisely how much you'll pay is to look around and get quotes from insurers. Among the variables insurance firms make use of to identify rates is location - money. People who reside in areas with higher theft prices, accidents, as well as all-natural calamities typically pay more for insurance policy. And because insurance laws and also minimal insurance coverage demands differ from state to state, states with higher minimum demands normally have greater ordinary insurance prices.

Most yet not all states allow insurer to utilize credit rating when establishing rates. In basic, candidates with reduced ratings are extra likely to file an insurance claim, so they normally pay extra for insurance policy than motorists with higher credit rating scores. If your driving document consists of accidents, speeding tickets, DUIs, or other infractions, expect to pay a higher premium. accident.

Cars with greater price normally set you back even more to guarantee - perks. Drivers under the age of 25 pay greater prices as a result of their absence of experience as well as boosted mishap risk. Men under the age of 25 are typically priced quote higher rates than women of the exact same age. Yet the void diminishes as they age, and also women may pay somewhat more as they age.

Because insurance firms tend to pay even more insurance claims in high-risk areas, prices are typically higher. Obtaining sufficient insurance coverage may not be economical, however there are methods to get a discount rate on your car insurance.

Examine This Report about Tesla Insurance

If you possess your home rather than renting it, some insurance providers will certainly offer you a discount on your auto insurance premium, even if your residence is guaranteed through an additional business. Aside From New Hampshire as well as Virginia, every state in the nation requires chauffeurs to preserve a minimum amount of responsibility insurance coverage to drive legally.

It might be tempting to stick to the minimum limits your state requires to minimize your premium, but you could be putting on your own in jeopardy. State minimums are notoriously low and also could leave you without appropriate security if you're in a major accident. A lot of professionals recommend keeping sufficient coverage to shield your properties.

Looking into for the appropriate insurance coverage firm that fulfills your demands is commonly the initial step, but you likely have concerns about insurance coverage companies, plans, and rates. When contrasting quotes, you may question, what is the average expense of vehicle insurance policy? It's practical to comprehend the variables that can affect your auto insurance prices - cheaper car insurance.

On an annual basis, car insurance policy costs typically drop between $926 and $2,534 each year per automobile, yet these costs can differ based on the area, company, and protection chosen. Right here are several of the factors that influence the expense of automobile insurance coverage: State and place Your geographic location might play a crucial function in determining the costs amount for your automobile insurance coverage (auto).

Some states additionally call for Accident Defense (PIP) protection and some places think about climate and also environment when identifying car insurance coverage expenses - cheaper auto insurance. Discover what car insurance coverage is called for in your state. Age As a vehicle driver with reputable auto insurance coverage, your prices will likely change gradually, relying on your age.

Not known Incorrect Statements About Tesla Insurance

This is normally as a result of lack of experience and harmful driving habits. cheaper. motorists over the age of 70 are extra most likely to trigger an accident than middle-aged motorists, however less likely than teen drivers. Based on this data, teenager and also senior vehicle drivers might pay even more when acquiring automobile insurance policy than middle-aged motorists.

cheapest auto insurance auto insurance cheapest auto insurance

cheapest auto insurance auto insurance cheapest auto insurance

New cars and trucks can be pricey to insure due to the fact that they come with new components and higher substitute values than older makes and designs. Car dimension can also impact auto insurance coverage prices. insure.

Annual gas mileage When investigating how much cars and truck insurance policy need to cost, keep in mind that insurance coverage costs are based primarily on the danger associated with your vehicle. Driving document Your driving document assists address the concern: exactly how much should I be paying for automobile insurance? Auto insurance policy companies commonly pay interest to an individual's experience and also driving record.

According to research study, married individuals are considered extra financially steady and much safer chauffeurs than solitary people. A married driver can compensate to $96 much less each year for their car insurance policy. Married individuals are likewise more probable to be house owners and bundle policies - cheaper auto insurance. Incorporating auto insurance coverage with residence insurance is a very easy means to minimize your vehicle insurance coverage premium.

How Safety Insurance can Save You Time, Stress, and Money.

State Farm, Travelers, and Nationwide also have insurance coverage prices that are more affordable than the national standard, according to our research. That said, there are a great deal of variables that affect exactly how much you'll pay for vehicle insurance coverage, and also we'll take a look at a few of them below. These auto insurance prices factors include your age as well as other group info, your credit report as well as credit report, your driving record, and whether you purchase minimum insurance coverage or complete insurance coverage.

Vehicle insurance provider generally think about variables such as your age, gender, marriage status, house address, credit scores background, driving document, and also the kind of auto you drive, in addition to the insurance coverage legislations and also guidelines in your state. trucks. Shopping about is the most effective method to discover the most effective automobile insurance coverage prices. Make certain to compare quotes from several different insurance coverage firms.

Our research study identified typical auto insurance policy prices for a selection of client groups, there are a lot of private variables that may make your rates reduced or higher than those shown below., and also various other ways to cut prices.